where's my unemployment tax refund 2020

You donât need to do anything. Your tax return will be processed with the updated requirements.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Loans are offered in amounts of 250 500 750 1250 or 3500.

. The Internal Revenue Service said Tuesday its sending nearly 4 million more refunds to people who overpaid taxes on unemployment compensation received in. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 Connecticut calls outside the Greater Hartford calling area only or 860-297. Updated March 23 2022 A1.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. This is an optional tax refund-related loan from MetaBank NA. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022.

Visit Wait times to. It is not your tax refund. This threshold applies to all filing statuses and it doesnt double to.

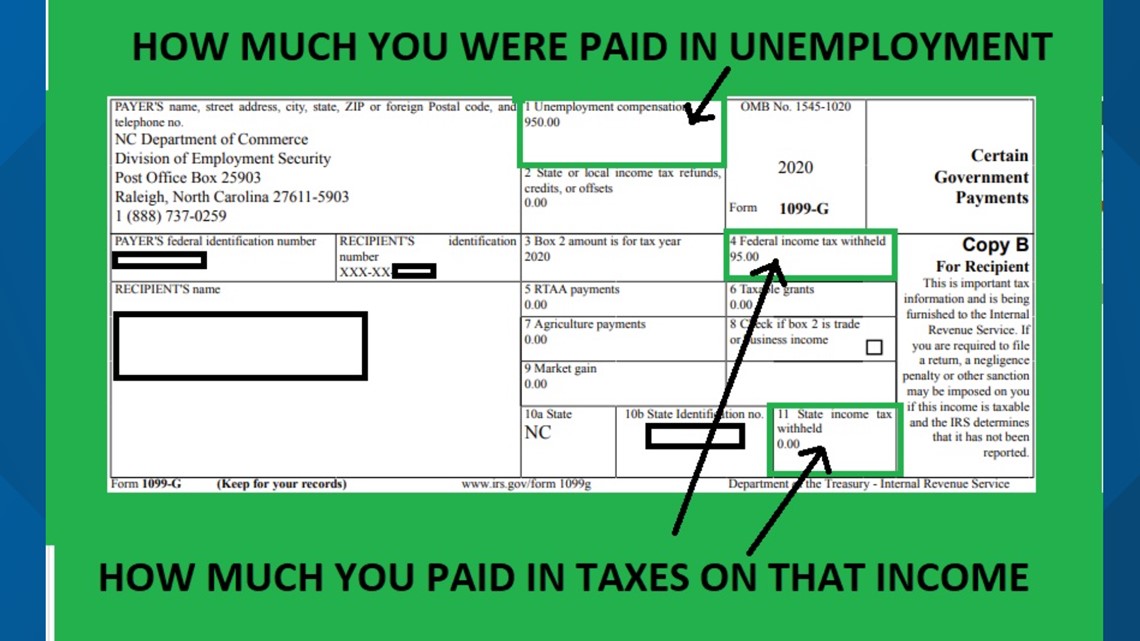

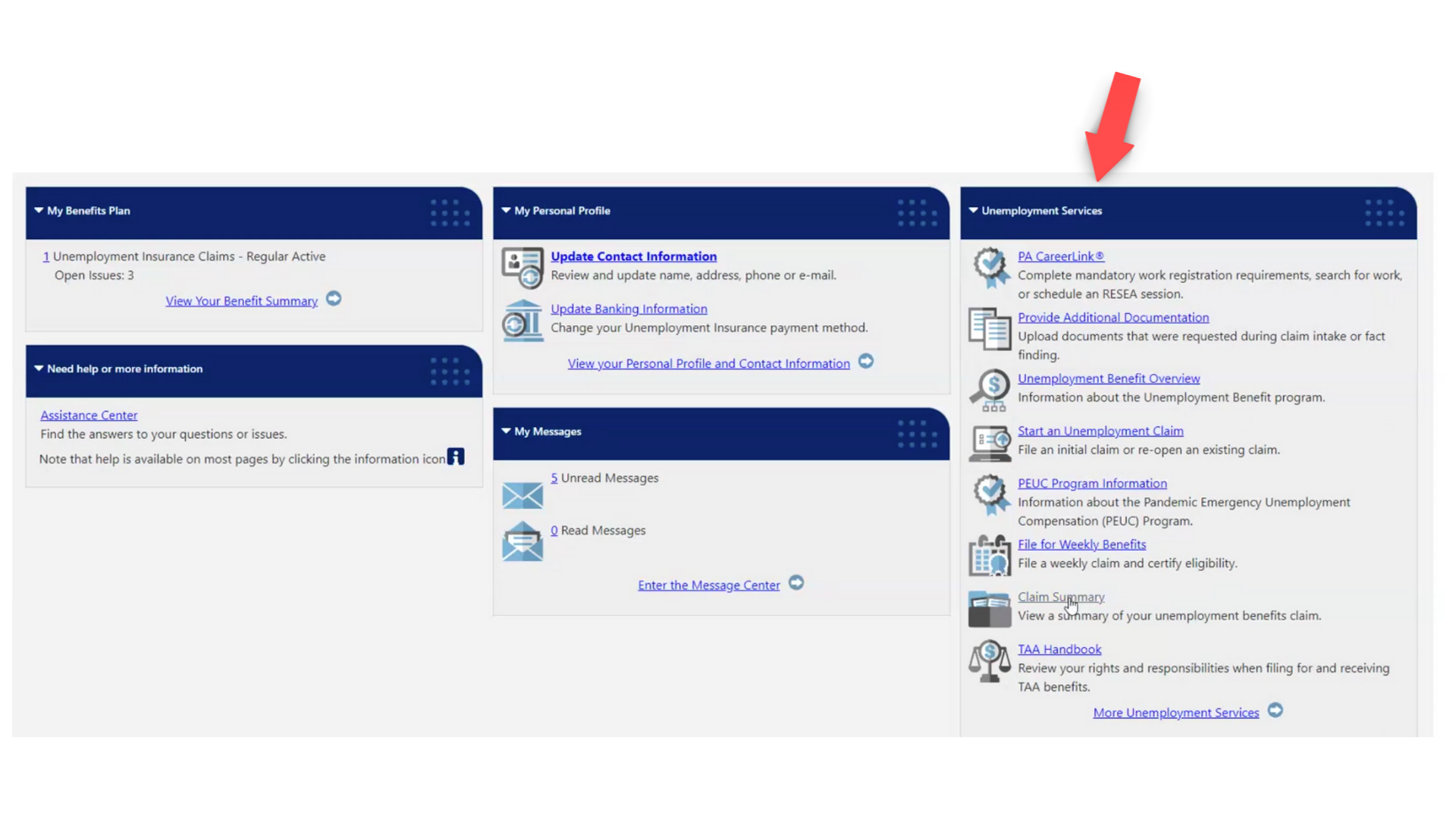

Will I receive a 10200 refund. To get to your refund status youll need the. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in.

1222 PM on Nov 12 2021 CST During the month November the IRS might surprise you with a deposit or an extra refund check for your. The first 10200 of unemployment benefits will not be taxable for those who earned 150000 or less in 2020. The IRS has sent 87 million unemployment compensation refunds so far.

Problems with 2020 indian challenger. Approval and loan amount. Sda general conference session 2022.

Tax Exemptions for Unemployment Benefits. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. July 14 2021 207 PM.

The refunds are the result of changes to the tax law authorized by the American Rescue Plan which excluded up to 10200 in. This amendment to the legislation. Check The Refund Status Through Your Online Tax Account.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. Access this secure Web site to find out if the Division of Taxation received your return and whether your refund was processed.

The 2021 tax year might rapidly be drawing to a close but the Internal Revenue Service is still busy issuing refunds to people for 2020. The tax agency says it recently sent.

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Just Got My Unemployment Tax Refund R Irs

Unemployment Benefits Are Taxable Look For A 1099 G Form Wfmynews2 Com

8 5 Million Tax Refunds Have Yet To Be Sent What To Do If You Haven T Received Yours Gobankingrates

Millions Still In Line For Unemployment Tax Refunds

H R Block Turbotax Help Filers Claim 10 200 Unemployment Tax Break

Where Is My Tax Refund 2021 How Long Does Irs Take To Process Taxes

Unemployment Tax Refund When Will I Get My Refund

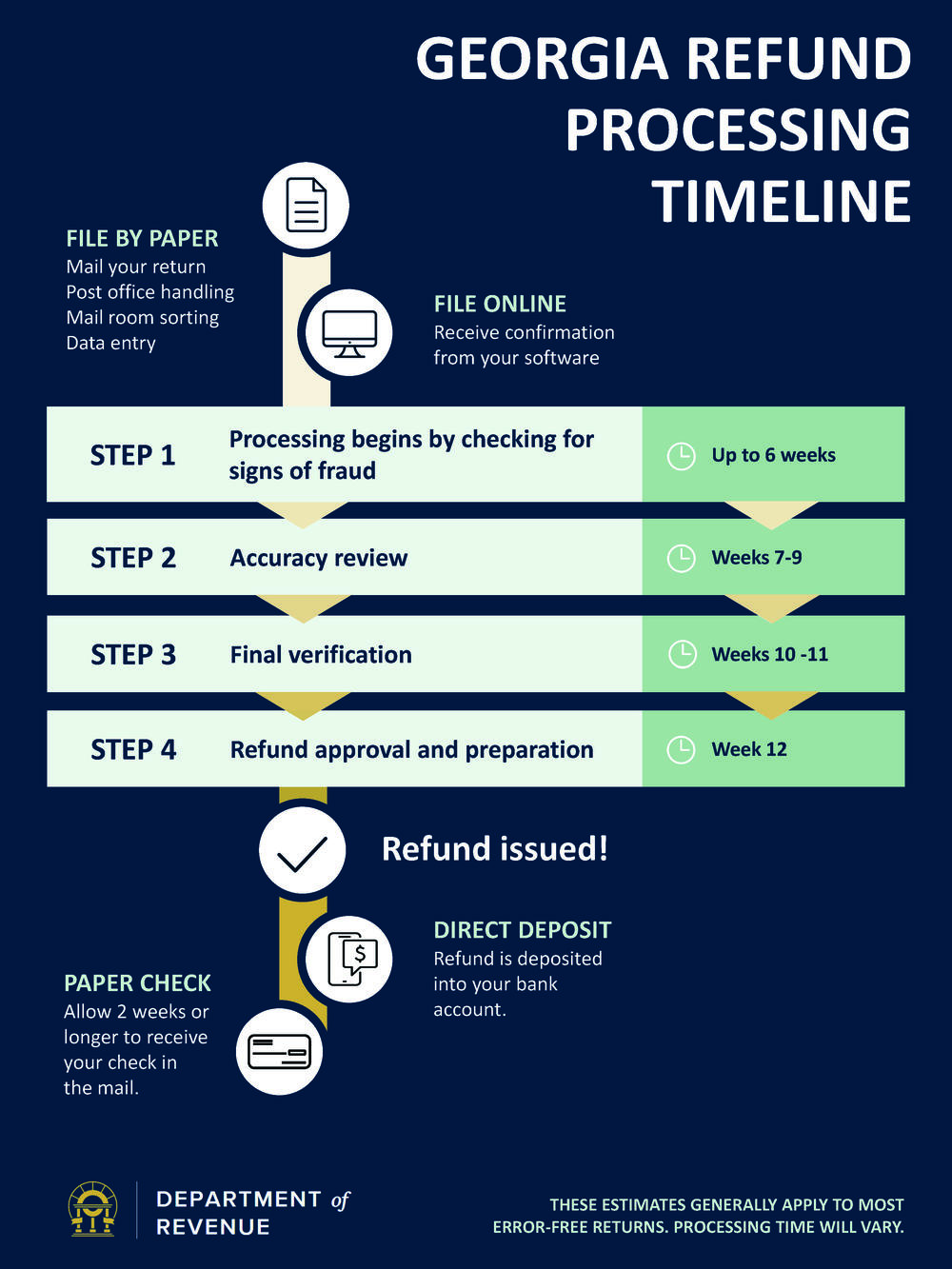

Where S My Refund Georgia Department Of Revenue

Irs Unemployment Tax Refund Update Direct Deposits Coming

What To Know About Irs Unemployment Refunds

Unemployment Refunds Are Coming Everyone R Irs

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Unemployment Benefits Tax Issues Uchelp Org

Exclusion Of Up To 10 200 Of Unemployment Compensation For Tax Year 2020 Only Internal Revenue Service

Your Tax Return Is Still Being Processed The Accountants For Creatives

Report Unemployment Benefits Income On Your Tax Return

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest